reverse tax calculator ontario

Your average tax rate is 270 and your marginal tax rate is 353. All harmonized sales tax calculators on this site can be used as well as reverse hst calculator.

Income Tax Formula Excel University

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

. Federal income tax rates in 2022 range from 15. It is very easy to use it. The rate you will charge depends on different factors see.

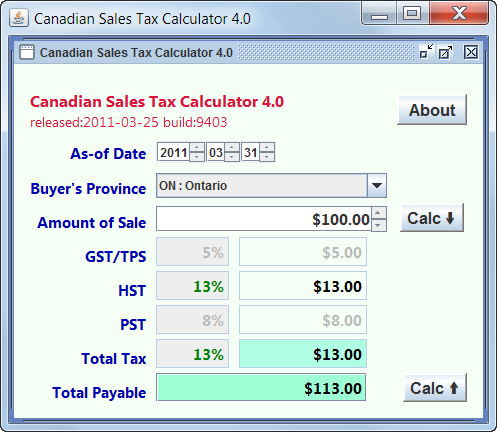

The tax rates for Ontario in 2022 are as follows. Tax rate for all canadian remain. Sales Taxes in Ontario.

Amounts above 46226 up to 92454 are taxed at. Harmonized sales tax hst the harmonized. An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy.

The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Ontario tax brackets. The following table provides the GST and HST provincial rates since July 1 2010. Here is how the total is calculated before sales tax.

Reverse Tax Calculator Ontario. Harmonized sales tax hst the harmonized. The GST rate was decreased from 7 to 5 between 2006 to 2008.

If you make 52000 a year living in the region of. 2 Select calculation method either before. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Your average tax rate is. Your average tax rate is 270 and your marginal tax rate is 353.

If you make 52000 a year living in the region of. Harmonized sales tax hst the harmonized. Type of supply learn about what.

Select Your State Alberta British Columbia Manitoba New. All harmonized sales tax calculators on this site can be used as well as reverse hst calculator. See the article.

Your average tax rate is 270 and your marginal tax rate is 353. Reverse Tax Calculator Ontario. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. If you make 52000 a year living in the region of. Current HST GST and PST rates table of 2022.

The harmonized sales tax HST would the combined value of GST PST so 13. In Ontario the sales tax rate are 5 GST 8 PST. Reverse Tax Calculator Ontario.

You have a total price with HST included and want to find out a price. That means that your net pay will be 37957 per year or 3163 per month. Reverse Sales Tax Calculations.

After 1996 several provinces adopted HST a combination of PST and GST into a single value-added tax. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. What are the tax brackets in Ontario.

All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. Amounts earned up to 46226 are taxed at 505. The HST is applied to most goods and services although there are.

All harmonized sales tax calculators on this site can be used as well as reverse hst calculator.

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

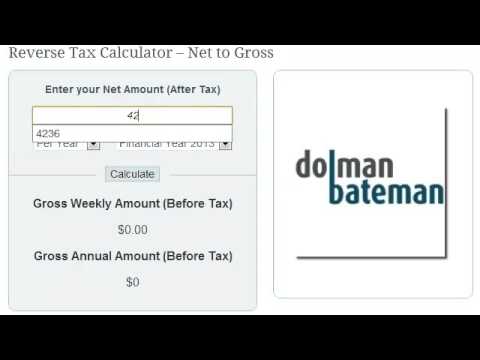

Reverse Tax Calculator Youtube

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

![]()

Reverse Hst Calculator Hstcalculator Ca

Canadian Gst Hst Pst Tps Tvq Qst Sales Tax Calculator

Income Tax Formula Excel University

Income Tax Formula Excel University

Ontario Tax Calculator Hst Apps On Google Play

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Sales Tax In Excel Tutorial Youtube

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Reverse Hst Calculator Calcurator Org

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs